Find Out Why This 20+ Year Mortgage Veteran Dumped His 2.75% FIXED Rate For A Rate That's MORE THAN TWICE As High

...and Why You Should Too!

Jason Iacovelli

20+ Year Mortgage Veteran

NMLS# 3370

"The industry I loved had been lying to all of us for years...convincing everyone to focus on the wrong thing so they can keep you in debt forever! Once I discovered these secrets, it's all I've been able to think about."

Why Would Anyone In Their Right Mind Take A Higher Rate On Their Mortgage?

I know it sounds crazy. I thought the same thing when I first got wind of this but after hearing it 3 or 4 times I figured I should look into it.

And down the rabbit hole I went.

What I Found Out Changed My Life...

Personally & Professionally!

You might have heard about it (or something similar) and it probably sounded nuts to you too. Intriguing but crazy. But the fact is, the numbers don't lie and it's a simple concept that will reverse the interest power from the banks, back to your pocket where it belongs.

I'm getting ahead of myself... let me back up a second and answer the question...

"Why Would Anyone In Their Right Mind Take A Higher Rate On Their Mortgage?"

The answer is actually quite simple...

It's because with this program...

you can legally and ethically pay off your mortgage and be entirely debt free in as little as 5 to 7 years!

and you can do it without making extra payments, bi-weekly payments, pinching pennies or even changing your lifestyle & spending habits

"Yeah, right! How can that be possible?" -- That's what you're thinking, isn't it?

Don't worry. I had the same thoughts when I first saw this. Let me explain.

You've heard of "Compound Interest", right? Do you remember what Einstein said about it?

Think about that for a second. "He who understands it, earns it. He who doesn't, pays it."

It's a pretty powerful quote and spot on.

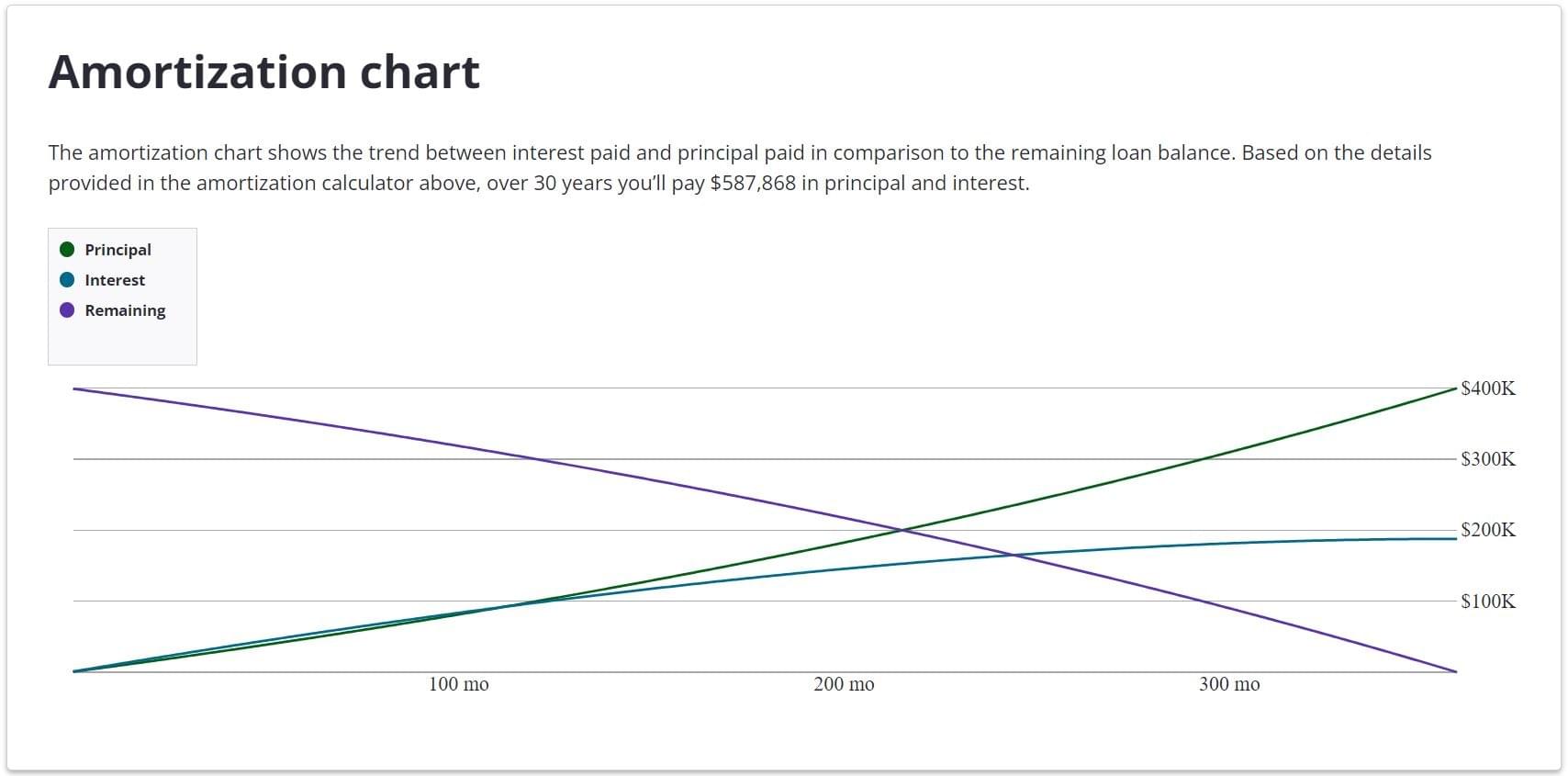

You see, traditional conventional, FHA & VA 30 year fixed rate mortgages are built on compound interest and not in your favor.

They're reverse engineered to work best for the banks while selling you on a "low rate" and "low payments".

The problem with that is that they front load most of the interest because they know most people will never get ahead of it. That's why for the first handful of years, more of your payment goes to interest than principal.

Don't believe me? Take a look at this amortization chart.

They Know You'll Refinance Or Move In 6 to 10 Years!

That's The Average... And When You Do...

You'll Still Owe Them As Much As 85% Of The Loan Balance

Even Though You've Already Paid Over 30%!

(and that's if you got a great rate!)

"Sure, but there's nothing we can do about it."

According to Forbes, only 37% of home buyers will ever own their home outright.

Will You Be One Of Them? Can You Be?

According Forbes, only 37% of home buyers will ever own their home outright.

Will You Be One Of The 37%?

Can You Be?

The answer is an emphatic... "YES!"

Let's take a little trip down memory lane.

Way back in 2006, I came across the concept through a company selling high priced fancy software that told you how and when to pay your bills.

The concept was fascinating but the idea of paying $5,000 for software and being left to my own devices didn't sit well with me.

Not to mention those were crazy times in the housing and mortgage industry and within a couple years the housing crash led to loan programs drying up and options coming off the table.

Fast forward to 2016 and I stumble across someone pitching the same concepts through a "coaching" program.

I say "coaching" because after doing my due diligence (aka coughing up the dough), I realized that while the information was good, they were keeping the "software" behind the closed doors, selling people and not exactly coaching.

You see, after paying them and being "sold" you still had put all the pieces together and every month do all the right things or it was never going to play out like they said. Being left to our own devices is a surefire recipe for disaster for most of us.

A lot of what they said to do meant a lot of work on the clients end and it didn't necessarily play out like it should. Still a great concept... just poor delivery, poor execution and too much room for failure.

Frustrated... I thought "There has to be a better way!"

If I have 20 years in this industry and find implementing this too difficult, how will the average family, with no mortgage or financial background, ever be successful with it?

I spent a long time and many late nights searching the internet, sifting through Facebook Groups and talking with other mortgage professionals until one day, by chance, I get a Zoom meeting invite from a loan officer I barely knew who would be presenting what she was using.

Reluctantly, I got on that Zoom call.

And that's when everything changed!

I sat in on the Zoom meeting, listened, took notes and asked tough questions (I wasn't falling for another crappy program full of holes like in the past).

Then I went from Zoom call to regular call, to YouTube, to calls to the company, meetings with their execs, customer-facing trainings, Zoom calls with their trainers and finally, FINALLY... certification!

I was beyond hooked.

Remember earlier with I brought Einstein's quote on compound interest?

Here's why...

If You're Going To Beat The Bank At Their Own Game, It's a MUST That Your Payments To Them Are Based On Simple Interest!

And that's exactly what this program does and more!

By flipping the interest from what the bank wants to what benefits you the most, it puts all the power back into your hands, removes the front loaded interest and maximizes your cash flow while absolutely destroying your mortgage... and it does it all with you not spending one red cent more than you do now or changing your lifestyle or needing to get a higher paying job!

INTRODUCING...

The Home Equity Recapture Of Interest Contract (HEROIC) Loan

is your opportunity to truly own your home free & clear.

Thousands of homeowners just like you have taken advantage of this program and you can too! Just like them, you can be FREE & CLEAR once and for all and you can do it...

- ...in less than half the time of a traditional mortgage! (Many homeowners are out in under 5 years!)

- ...without spending a dime more than you do now! (Although you're free to pay it down faster if you choose to!)

- ...without pinching pennies! (No lifestyle changes required! Live your life and still get debt-free!)

-

without taking a 2nd (or 3rd) job! (If you're working another job, it better be because you want to!)

-

...and without robbing a bank! (Seriously, please don't do that.)

Be HEROIC for your family and find out what it can do for you.

How Does It Work

Much like I had, you may have heard of people talking about a Home Equity Line of Credit (HELOC) strategy for paying off your mortgage faster. The HEROIC Loan utilizes the same concepts but with certain distinctions that make it head and shoulders above the rest.

In case you're not familiar, the HELOC strategy to pay off your mortgage is commonly used in Australia & Canada in place of the traditional mortgage we've all come to know and love. 🙄

HELOCs have two key features that make them a much smarter tool for homeowners:

- Simple Interest: See Einstein's quote above; If you're going to pay interest, make sure it's not front-loaded compound interest. HELOC's solve this problem.

- Interest Is Calculated On Your Average Daily Balance: This means if you start the month owing $10,000 and you immediately pay $1,000 to bring it down to $9,000, the interest due for the next month is based on $9,000 versus being predetermined based on the $10k or whatever amount you started with.

These two features are very powerful and it's what allowed the software company I heard about in 2006 to exist and the countless high-priced "coaches" to spring up promising the world.

But it's not enough to just get a home equity line of credit. What kind of line of credit? From what bank? And what do you do with it once you have it?

"Ok, sure. That makes sense but I can probably read about it online, watch a YouTube video or two and then stroll over to my bank for one of these HELOC's, can't I?"

The short answer... maybe.

Going It Alone Is... well... Lonely.

For starters, getting a HELOC isn't as easy as it sounds.

A lot of major lenders stopped offering them and if they do, they'll only write them as a 2nd loan behind your current traditional 1st mortgage and all it's front loaded interest.

Better than nothing, but not exactly ideal.

But let's pretend you're ok with "less than ideal"...

You get your HELOC, hope they don't have a bunch of silly behind the scenes policies to sabotage you and you figure out the right timing to move money, transferring funds from your checking to the HELOC to the mortgage, and... it makes my head hurt just thinking about it.

This is where "coaches" fail the ones they "coach". They send you out to get "whatever" and then don't stay on top of you to make sure you're doing it right like a real coach would.

If that's what you signed up for, that's what you should get it... (and don't get me wrong, I'm no coach either. But I'm not trying to talk you into hiring me as your coach!)

Even if you have it all figured out, or just think you do, life has a funny way of happening.

Imagine you need to move money from the HELOC to pay the mortgage on the 1st of the month and then move money from the checking to the HELOC to not incur interest charges there. Sounds simple enough.

Now imagine the 1st of the month falls on the Saturday of holiday weekend and you're going out of town on Thursday and any bank transfers won't process until Tuesday at best. Now what do you do? Did everything just get screwed up?

Now imagine that you'll be away for a week and you're having a blast with family or friends before you realize you didn't move the money on time (or at all).

Or what-if something expensive pops up that you need to jump on (good or bad)... how does that fit in the mix? What do you do then?

All of these issues (and more) are solved with the HEROIC loan.

This Ain't Your Daddy's HELOC

The HEROIC Loan is specially designed for getting you FREE & Clear in the shortest amount of time possible and with the least amount of headache.

If you can set up direct deposit, use a debit card and not go crazy with your spending habits, virtually everything else is taken care of for you.

Let's compare...

The HEROIC Loan

- Convenience: Fully functional account designed to be your "checking account" as well as your mortgage, eliminating the need for multiple accounts at multiple banks!

- DFY: Done for you solution so you only have to set up direct deposit and go about your business as normal. The HEROIC loan will handle the rest.

- Long Term Use: Keep using it for 30 years (even if you're paid off in 10 years or even less). The HEROIC loan stays with you, ready for all of life's events.

-

Efficiency: By combining the HELOC and checking functionality, payments are credited on time, at the right time, every time.

The Other Options

-

Requires Separate Accounts:

2 or 3 accounts needed making it confusing, messy & less effective - DIY: Do It Yourself is fun for projects around the house but deadly for your finances. If you're on your own, the odds of success go way down.

- Limited Time Frame: Typical HELOCs can be drawn on for 10 years and then become a standard front loaded mortgage with a 20 year term. If you're aren't paid off in 10 years, you're out of luck!

You Can't "Un-Know" What You Just Learned

At this point I'm sure the idea of paying off your mortgage in less than half the time and maximizing your cash flow sounds great, but sounds a little "too good to be true", doesn't it?

That's perfect reasonable. When something is such a shift to the normal way of doing things, it always raises skepticism and fear.

I don't blame you for that. I wouldn't want to put my family at risk chasing some crazy idea. Take a look at the frequently asked questions below. Hopefully they put your mind at ease.

Frequently Asked Questions

From Homeowners Just Like You

Notice how even with that ultra low traditional mortgage AND an ultra high HEROIC loan rate, the HEROIC loan still edges out the extra payment of $500 per month. Not to mention the cash flow of the extra payments option goes down because that money is stuck in equity and you can't reuse it for anything! (By the way...

Complete Our Quick & Easy Quiz To Get Your Full Analysis

Find Out If The HEROIC Loan Will Work For You

Testimonials From Homeowners Like YOU

Who Decided To Get Their Analysis Done, Saw The Math, Took The Leap Of Faith To Change Their Family's Future For The Better & Haven't Looked Back!

My only regret is not doing it sooner."

Diane H. - Cary, NC

Randy T. - Raleigh, NC

James & Jen G. - Apex, NC